Creative Destruction, Concentrated Liquidity and Beefy’s Next Generation

Meditate with me for a moment on the nature of revolutionary innovation:

Consider an idea which is capable of uprooting the global order. To reach critical mass, it must undergo continuous creation and destruction. Amazing inventions inspire exceptional design and engineering. That means endless experimentation, competition and optimization. It requires pinpoint accuracy, the eradication of faults, and conquering the final 1% between excellence and perfection. And it relies on enormous dedication from thousands of passionate and intelligent contributors who share commitment to the cause. Innovation is creative destruction.

With these reflections in mind, we at Beefy are preparing for the complete and total destruction of our operating model… a total redesign of the liquidity flywheel. Those who have been in DeFi for a while now have seen this before: new projects erupt and burnout, liquidity incentives flow until they dry, and smart contracts old and new one way or another meet their demise. If we don’t focus on what’s coming next, soon enough we’ll all be surpassed.

As such, we are extremely excited to usher in the next generation of yield optimization technology, with new concentrated liquidity vaults on Beefy. More efficiency, optimal fees and greater yield means a better experience for everyone. Creative destruction in motion.

Concentrated Liquidity

Concentrated liquidity (“CL”) unlocks more flexible, efficient and profitable liquidity positioning, for a superior experience for users and providers alike. First introduced by Uniswap as part of the Uniswap V3 White Paper, CL brings the promise of deeper liquidity with smaller amounts of deposits by more efficiently utilizing liquidity to meet current price ranges.

CL works by allowing liquidity providers to configure their liquidity within a specific price range, rather than across the whole pool. This means individual providers can represent a greater proportion of the liquidity in their range rather than a proportional split of liquidity across the entire pool, thereby earning a greater proportion of fees on the same nominal amount of liquidity provided.

With CL pools, projects can achieve significant liquidity for their tokens and products quickly, and with less capital deposits required. This unlocks markets for new products more quickly and efficiently than ever before. And the benefits don’t stop there: for users, CL means easier access to the tokens you’re wanting to acquire or sell; and for liquidity providers, it means greater fees and greater returns than from traditional pools.

No Risk, No Reward

As ever, this added functionality doesn’t come completely without downsides. The key drawback is that - in exchange for the promise of greater fees within your configured range - where the current price of a CL pool falls outside the range of your position, it becomes “inactive” meaning you won’t earn any fees. For volatile assets, this means your options are limited to wide ranges, regular range adjustments or the risk of earning nothing if the price changes enough.

Another point to consider is the safety of CL products. Though the concept for Uniswap V3 is over 2 years old, the business source license that the product was released under has meant no forks were permitted on the market until the expiration in April 2023. Though many forks are now arriving, and some pioneers have built their own rival CL products, only Uniswap’s V3 product has been battle tested over years of use.

There’s also a need to be very careful with forks and alternative designs, as even minor changes to the main battle-tested code can result in critical faults and full monetary loss for unlucky users. Though the UI and product descriptions may sound very similar, it’s therefore important to be extremely careful about what CL products you use in these early days, and how you go about using them.

Enter Beefy

With those risks in mind, we are thrilled to be bringing CL vaults to Beefy. We pride ourselves on being a “set it and forget it” option for all users at every skill level, where you can rely on our diligence and safety processes to access the best yields in DeFi simply and easily. Every CL vault on Beefy has been extensively safety checked and reviewed to meet our high standards, helping you to sleep easily at night while your yields compound.

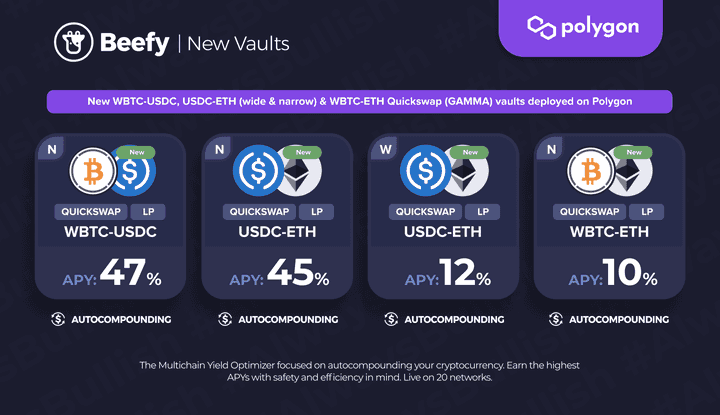

Better still, by building on top of other range and fee management tools, we can offer managed CL positions that never fall out of range. With Gamma Strategies’ dynamic range model, each of our new CL Beefy vaults automatically responds to price changes and volatile markets. And with Algebra Finance’s dynamic fee model, higher fees can be set in appropriate circumstances, ramping up the rate of return achieved in active or sparse markets.

By bringing together tools to mitigate the risks of CL positions with our autocompounding technology, Beefy is able to offer a single solution to seize the latest waves of opportunity. We are also thrilled to be delivering our latest products alongside our existing network of partners, starting off with our close friends at Thena on BNB Chain and QuickSwap on Polygon. With over 15 strategies already available, new opportunities are coming in fast!

Next Generation

The emergence of concentrated liquidity is creative destruction in motion. It’s inspiration for exceptional design and engineering, and cause for experimentation, competition and organization. Only through the relentless pursuit of perfection can we bring the promise of blockchains and digital assets to the masses.

With the introduction of our brand new CL vaults, we at Beefy are building towards that better future for all of us. We want to welcome the next generation of liquidity with open arms, and deliver the abundance of opportunity it promises safely and simply to all of our users. And as the market expands and solidifies, we’ve got a lot more in store to showcase the full potential of this technology… 👀

Welcome to the future.

V3 White Paper | Gamma Strategies | Algebra Finance | Thena | QuickSwap