Autocompounding Overnight with USD+ on Beefy

It’s an exciting time to be involved in Web 3.0. Traditional financial systems are undergoing daily seismic shocks, and it feels as if we’re fast approaching the tipping point of the crypto revolution. We crypto natives believe that the technologies underlying decentralized finance are capable of solving the flaws which have caused repeated failures in traditional finance. And we are very early to the party…

With all that said, we must recognize that DeFi is not yet finished or in a position to solve all the problems of the old system. For instance, even our strongest stablecoin designs which have unlocked so much composability in DeFi still see their real economic value being eaten away by the ever-pressing inflation of their pegged fiat currencies. Ultimately, to break free from these timeless tradeoffs, we still need to push forward to new technologies and solutions, to bring us into the future.

So today, we at Beefy are celebrating our partnership with Overnight Finance, and their novel solution to the problem of stablecoin inflation: their $USD+ token.

Rebasing Stablecoins

$USD+ is a rebasing stablecoin pegged to Circle’s $USDC token. By “rebasing”, we mean that every holder’s balance is continually inflated by the underlying smart contract, such that the quantity of $USD+ accounted to your wallet increases every day (ovenight!). By maintaining a 1:1 peg with $USDC, this also means you’re earning a return on the nominal amount of your deposit just by holding $USD+. With 5-15% average APY, it offers the benefits of a stable asset for trading whilst helping you to beat inflation.

The design of $USD+ facilitates instant minting or burning of any quantities in exchange for $USDC. To deliver this, the token must be 100% collateralized at all times, to ensure that your funds are available for withdrawal whenever you need them. Overnight facilitates the rebasing of the token by investing your stablecoins in lending protocols, stable liquidity pools and DeFi strategies. The breakdown of strategies used by the token is available on the Overnight app.

One of the most novel aspects of $USD+ is the reliance on delta-neutral strategies - meaning investments where exposure to a particular asset is matched with a corresponding hedge against that exposure, which neutralizes the risk. The result is access to higher yields on non-stable assets like ETH, whilst maintaining the risk profile of stablecoins.

Following on from the success of $USD+, the team at Overnight have recently released a sister token, $DAI+, to bring the power of their innovation to new markets. The hope is that over time, inflation-resistant stablecoins can become as accessible and integrated as the largest stablecoins have now become.

Optimize with Beefy

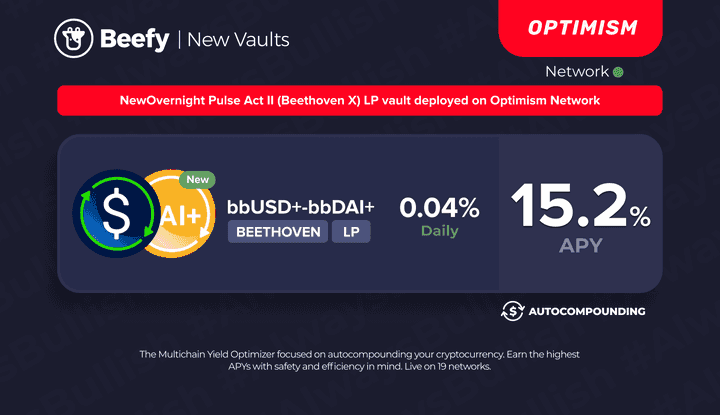

At Beefy, we love seeing new innovations taking root, and watching as DeFi rapidly solves problems that have plagued our financial system for millenia. That’s why we’ve seized the opportunity to partner with Overnight, by deploying a selection of $USD+ vaults for our users. With vaults live across a number of DEXs on Optimism, BSC, Arbitrum and Polygon, you can zap into $USD+ today, and achieve enormous autocompounding returns in just one click. But that’s not all…

To celebrate the progress of $USD+ and our impressive range of Overnight vaults, we’re hosting a launchpool boost on our Overnight Pulse Act II Vault over the next four weeks. As part of the celebration, you can earn boosted $OP rewards throughout. To participate in the boost, simply enter the vault and stake your mooTokens in the “Boost” section on the vault page.

And there you have it! You’re now earning more through $USD+ strategies, LP trading fees, yield farm reward tokens, Beefy’s autocompounding magic AND Overnight’s $OP boost. That’s a dizzying amount of earning power for just a few clicks! So don’t hesitate to give $USD+ a go, and realize the wonders of inflation-resistant stablecoins. And prestake in our Overnight Pulse Vault to enjoy this launchpool boost. You’re welcome! 😘

Beefy App | Overnight.fi | Overnight App | $USD+ Docs | Overnight Pulse Vault